Question: If I only use one brand-name drug that costs $375 and has a $47 copay, will I enter the 2020 Donut Hole?

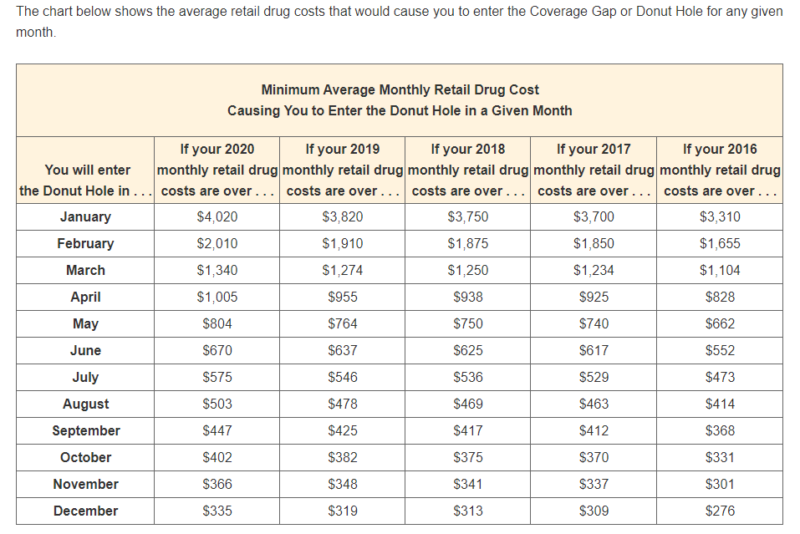

Yes, in November. If your retail drug costs average $375 a month, you will exceed your Medicare plan’s $4,020 Initial Coverage Limit in late-November and enter the 2020 Donut Hole. Remember, your plan’s full retail drug cost is what counts toward entering the Donut Hole. Your $47 copay has no impact on entering the Donut Hole, but will count toward exiting the Donut Hole and entering the Catastrophic Coverage phase.

The Donut Hole (or Doughnut Hole) is a term used to describe a gap in Medicare Part D prescription drug plan coverage or Medicare Advantage plan coverage during which the Medicare plan member was (previous to 2011) 100% responsible for the cost of their prescription drugs — unless their Medicare plan provided some brand-name or generic drug coverage through the Donut Hole.

Then starting in 2011, Medicare Part D prescription drug plans and the brand-name pharmaceutical drug manufacturers began to share a portion of your medication expenses while you are in the Donut Hole (giving you what we now call the Donut Hole discount).

The Donut Hole or Coverage Gap is actually the third part or phase of your Medicare Part D prescription drug coverage and you only reach this phase when your drug spending exceeds a certain point.

When will you enter the Donut Hole? You can reference the below chart to see when you might hit the Donut Hole.

Question: What will I pay for my $375 brand-name medication when I reach the Donut Hole?

You will pay around $94 in the Donut Hole. Once you enter the 2020 Donut Hole, you will pay 25% of the retail price for your brand-name medications – assuming that your Medicare prescription drug plan does not provide any additional Gap Coverage. However, you will get credit for 95% of the brand-name retail drug cost toward meeting your $6,350 total out-of-pocket threshold (TrOOP). So, you will pay $94 for your $375 brand-name formulary medication and receive $356 credit toward meeting your TrOOP. If you purchase a generic medication in the Donut Hole, you will also pay 25% of the retail price, but only what you pay will count toward your out-of-pocket threshold.

Question: Where can I see how close I am to the Donut Hole?

Each month your Medicare prescription drug plan sends you an Explanation of Benefits letter showing a summary of your drug purchases and how close you are to entering your Medicare Part D plan’s Coverage Gap or Donut Hole.

Question: If I reach the Donut Hole, am I allowed to use a drug discount card instead of my Medicare Part D plan?

Yes. Medicare Part D plan coverage is voluntary. So, if you find a pharmacy discount program or drug discount card that saves you more than the 75% Donut Hole discount, you can buy your formulary prescriptions without using your Medicare prescription drug plan. But a drug discount card cannot be combined with your Part D coverage.

Question: Will I receive the 75% Donut Hole discount on non-formulary drug purchases?

No. Only Medicare Part D prescription medications found on your formulary receive the 75% Donut Hole discount. Non-formulary medications, bonus drugs, and medications excluded from the Medicare Part D program, do not qualify for the Donut Hole discount – and your non-formulary drug purchases do not count toward meeting your $6,350 total out-of-pocket drug spending threshold (TrOOP).

Question: If my drug plan agrees to cover a non-formulary drug, will I then receive the Donut Hole discount on this drug?

Yes. If you are using a non-formulary medication that is not excluded from the Medicare Part D program, you can ask your Medicare plan for a Formulary Exception – a type of Coverage Determination that adds a non-formulary drug to your Medicare Part D plan coverage. If approved, your medication would then receive the 75% Donut Hole discount when you enter the Coverage Gap.

Please remember, if your Medicare Part D plan denies your formulary exception request, you have the right to appeal your plan’s decision.

If you would like more information about your Medicare Supplement Options, Call us at 800-362-2809 or Visit our webpage by CLICKING HERE